Secrets of Investing (Part1)

Then there are others who deliberately do not want to know anything about the activities of the company. They want to study the “pure” movement of the stock price with the belief that they can use this information to make forecasts about the future movements of the price. This is like trying to play bridge without looking at the cards.

It just makes no sense to ignore the fact that the stock symbol is attached to a company. And it makes no sense not to apply sound business principles to analyze these companies. The more we know about the company, then the more confident we can be about the price of the stock. Not on a day to day basis, but over time.

So before buying a stock, think of it in terms of buying a whole company, just as if you were buying a store down the street. If you were buying a store you would want to know all about it. What were its products? How consistent are the sales? Do they keep trying new products or do their products stay fairly constant? What competitors does the store have and what distinguishes it from them? What would be the most worrying thing about owning such a store?

This leads to the idea of looking for companies that have a strong and durable economic moat. Just as castles have moats to protect them from invaders, so companies can have economic moats to protect them from challenges of competitors and changes in consumer preferences. The moat can be made up of attributes such as brand name, geographical position or patents and licenses.

All these principles about purchasing businesses are equally applicable to purchasing shares. It becomes one of the most enjoyable parts of investing to look into the “business” aspects of any company that you are considering adding to your portfolio.

Secret #2: Don’t invest for ten minutes if you’re not prepared to invest for ten years

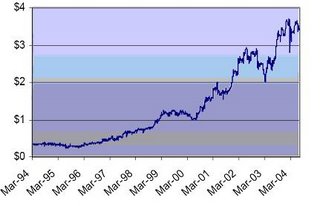

When we look at the share price of a company we usually see a wildly fluctuating graph with mighty hills and plunging chasms.

For example, on the right is the graph of the daily closing prices of a company over ten years. It would be a brave person who could look at this graph and say what was going to happen in the next 24 hours, let alone the next 5 to 10 years. Yet this is a typical graph of the prices of a listed company.

But what about this graph? Because it is growing so consistently we would have a lot more confidence in making forecasts of what was going to take place in the future.

This graph is of the earnings per share of a company. If you were buying a company, this is just what you would want — a company whose earnings and sales go up like clockwork by 15 or 20 percent or more each year. It is no different when you invest in companies via the stock market.

In fact, the above two graphs of the same company, ARB Corporation. This is an Australian company that manufactures and supplies equipment for off-road and four-wheel drive vehicles around the world. The first chart depicts the closing prices while the second chart displays the earnings per share over the same period.

When we put the two charts together, we see how they track each other. Sometimes the price moves ahead of the earnings per share and sometimes it is the other way around. But over time they move together

Clearly it is an advantage to be able to find companies with such steady and strong growth in earnings.

When we locate such companies, we are well on the way to finding quality investments.

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

Put together a portfolio of companies whose aggregate earnings march upwards over the years, and so will the portfolio’s market value.

In other words, as investors we focus on the medium to long term business characteristics of companies. It is these that drive the share price.

Focusing on the short-term aspects of a company including both business and price fluctuations is foolish Even though we focus on the long-term, the investment is even more profitable if we purchase the stock during one of its drops.

Secret #3: Scan thousands of stocks looking for screaming bargains

There are always companies, which are not the leaders today but have the potential to be in the future. So scan the possible number of stocks and find out some screaming bargains, which are available cheaply.

Secret #4: Calculate how well management is using the money they have

Home buyers understand about equity. It is the value of the home less the amount owed to the bank. The same is true of a business. Its equity is the total assets minus all the liabilities. You can think of this as the money locked up in the business. It is a measure of how much money management has to run the business.

Another measure of the money available to management is the capital of the business. This is its equity plus the long-term debt of the company.

Clearly the success of any business is going to depend on how well management uses its equity and its capital. This is commonly measured by two ratios called return on equity and return on capital. Putting it simply, these are defined as the earnings of the company divided by equity and by capital. Their abbreviations are ROE and ROC.

Many companies consistently lose money year after year. So they do not even have an ROE or ROC. Others have very low values for these ratios. In other words, management is struggling to make a profitable use of what it has. Clearly, these are not the sort of companies that we should think of as quality investments. If management is only making a few percent on the money that it has, then over time this is all you can expect to make if you purchase shares in the company. After all, money can’t come from nowhere. It makes sense. If you want a healthy return on any shares that you purchase, at the very least you need to select companies with management that is making a healthy return on the money that they have.

-----------------------------------Next (Part2)